What is Butterfly Spread Option? Definition of Butterfly Spread Option, Butterfly Spread Option Meaning - The Economic Times

What is Butterfly Spread Option? Definition of Butterfly Spread Option, Butterfly Spread Option Meaning - The Economic Times

/dotdash_Final_A_Newbies_Guide_to_Reading_an_Options_Chain_2020-01-92888ba78f8a4f519e037a483501af81.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

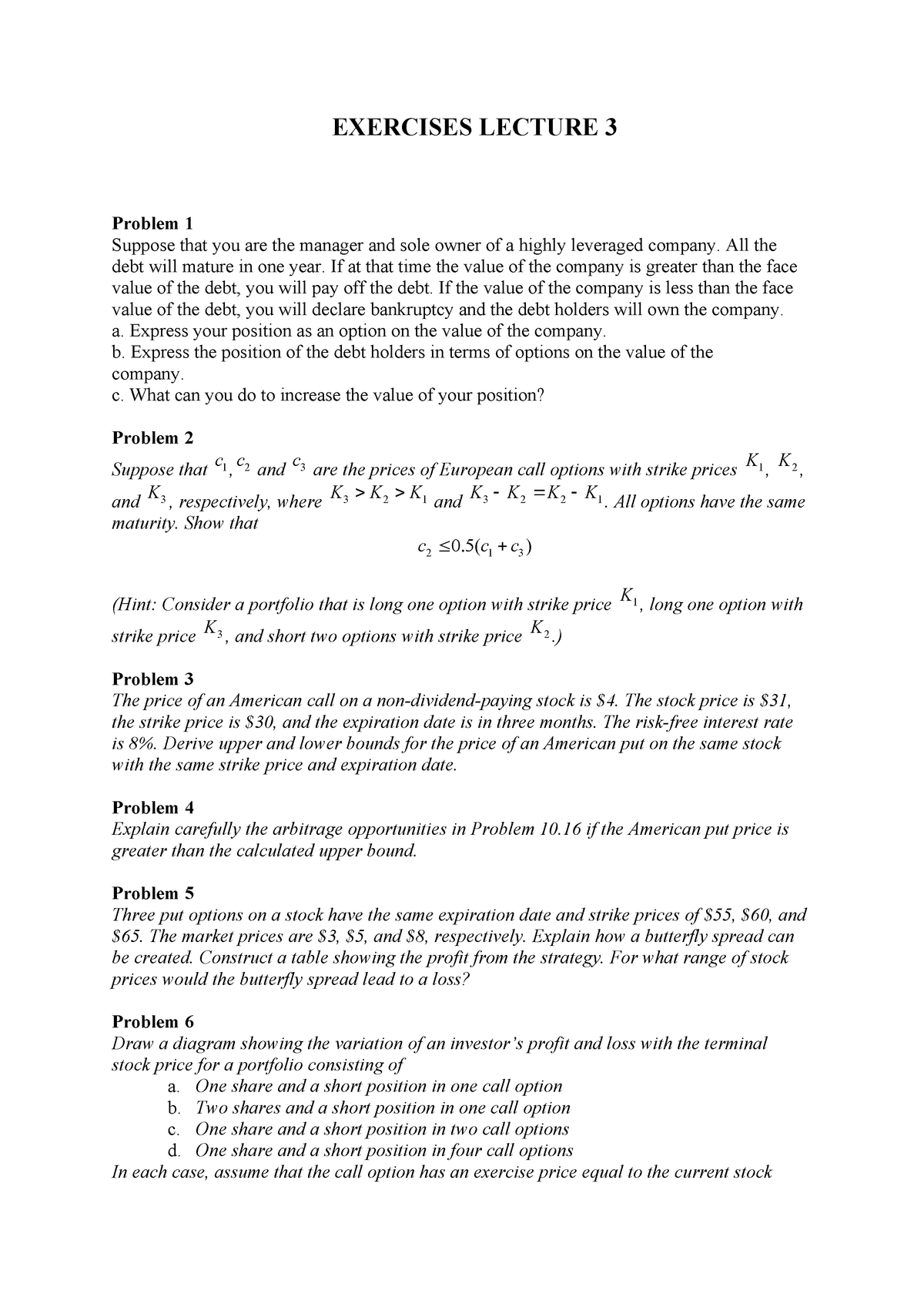

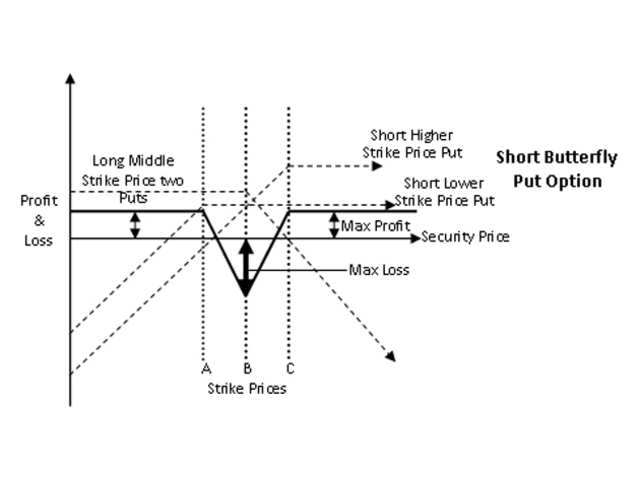

:max_bytes(150000):strip_icc()/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png)